Since the influx of spending caused by the COVID pandemic, healthcare investment has been on a rapid, followed by a steady decline. But it’s a decline that will return spending to a pre-pandemic, albeit low, baseline.

According to a peer review study published earlier this year in the Journal of Health Affairs, health spending is forecast to finally grow again at a rate of 5.4% per year, outpacing projections of 4.6%. More importantly, health spending share of GDP is expected to increase to 19.8% vs. predictions of 18.3%.

So, what does this mean for 2024? And what are the biggest trends likely to impact medical device, pharma companies and healthcare provider spending?

The highlights

It is perhaps unsurprising that digital transformation, virtual health and generative artificial intelligence (AI) are at the top of the list for the most transformative trends impacting medical device companies.

An emphasis on digital is seemingly less important to pharmaceutical and biotechnology companies who are citing regulatory changes as having the biggest impact on their businesses, followed by drug pricing and finally personalised medicine.

Healthcare providers list preventative healthcare as being the focus of their attention in 2024, followed by virtual healthcare (an overlap with medical device companies) and finally (and perhaps most interesting) 3D printing.

Digital transformation

When medical device companies talk about digital transformation as a transformative trend, they are broadly talking about ways to improve the bottom line, through the adoption and implementation of digital tools. Drivers for this include pricing pressures from buyers, more stringent regulations and operational inefficiencies.

Payers continue to demand lower-cost devices. But there has also been a shift to payers exploring value and outcome-based payment models. This has led to medical device manufacturers lowering the net cost of their devices in an inflationary economy where, in general, costs are rising across the board.

Regulatory challenges also continue to increase operation costs. Recent changes to the MDR have introduced a more thorough assessment of product safety and performance and have placed tighter scrutiny on clinical evaluation. There have also been calls to increase visibility of medical devices both through the supply chain and post-market surveillance.

This has led to medical device manufacturers having to assess whether some specific, older product lines generate sufficient returns to remain on the market, or whether they should be sunset / redeveloped. Digital tools are empowering medical device manufacturers to make informed decisions based on real-world data, collected from end users and the point of operation.

Virtual healthcare

The goal of virtual healthcare is to keep people out of hospitals, supporting patients in recovery and diagnosis from the comfort of their homes. Virtual assistants, powered by AI, are now able to help clinicians by providing advice on medication, treatments and even utilise patient data to offer advice on diagnosis.

Virtual assistants also help patients by collecting data about their condition / recovery and pointing them towards relevant information, empowering them to make informed decisions about the future of their care.

Finally, virtual assistants are supporting adherence. By interfacing with electronic patient records, they can schedule and book appointments, remind people to take medication, or even monitor people whilst they complete physio / other recovery exercises.

Generative AI

In 2022, more than 90% of responders to a Deloitte run report cited Generative AI as their top trend impacting healthcare and life sciences in 2023. This year’s report revealed that 66% of companies surveyed are currently experimenting with generative AI and half the remaining 34% have governance in place to start a program in 2024.

Current use cases for generative AI include automating back-office functions, supporting governance and regulatory affairs, improving supply chains and, perhaps most interestingly, creating synthetic data that can be used to train medical AI algorithms. This synthetic data can be used either when there is not enough real-world data or where data is locked behind patient privacy.

Regulatory transitions

When the global healthcare and life science industry talks about modern regulatory changes, they are generally referring to changes taking place in the EU, some of which include:

Identification of Medicinal Products (IDMP) Data Standards: There has long been a demand for international commonality in specifications for medical products. Under new IDMP standards, companies will be required to submit and maintain detailed product data electronically.

Medical Devices Regulation (MDR): The MDRs aim is to coordinate better efforts between EU member states, which will speed up the delivery of new devices / treatments whilst simultaneously safeguarding and helping to rebuild confidence. With this ‘new’ mission, the MDR is redeveloping many standards and is putting in place tougher regulations, which impact older devices in particular.

Clinical Trials Regulation: In the last 5 years, many pharmaceutical and life science companies have introduced a more transparent policy for reporting on clinical trial outcomes. This has been driven by the adoption of digital platforms providing better quality data and interpretation.

Drug pricing

2023 saw the Centres for Medicare and Medicaid (CMS) in the USA identify a list of high-cost drugs, that will have to be reduced in price in line with the Inflation Reduction Act (IRA). High-profit drugs like Hemgenix and Elevidys, which cost upwards of $3m for a single dose are going to see their prices reduced by up to 80%, directly impacting the bottom line of pharma companies.

It’s not just federal agencies that are working to reduce the cost of drugs. Many states (20 in total) have already adopted Prescription Drug Affordability Boards (PDABs) to control and cap what drug manufacturers can charge for their products.

All of this is great news for end users but does pose a unique challenge for pharmaceutical companies who see spiralling drug discovery costs as a justification for high drug prices.

Personalised medicine

Tailored treatment plans for patients, built using a combination of patient data and data sets pulled from comparable patients. Some of the most advanced applications of personalised medicine are taking place in the field of genomics and AI is already being implemented to analyse DNA to monitor a disease and create a specific medicine at a molecular level.

Advances in smart monitoring devices are making it easier to collect and store information about an individual. Continuous monitoring benefits both decision-making and prescribing the right medication based on real-world data and is also key in monitoring a patient’s response to a prescribed treatment.

Preventative care

Preventative care includes such topics as health and wellbeing, exercise, vaccinations and education. Ageing populations contribute significantly to health costs, but the highest cost to healthcare providers is still chronic conditions, with the most expensive condition to treat being diabetes. 90- 95% of diabetics suffer from type 2 diabetes, a condition which is both entirely preventable and ‘curable’ by adapting a patient’s lifestyle. On average, diabetes care costs $327b a year, of which 90 – 95% is potentially avoidable.

Heart disease accounts for a similar level of spend ($216b), and much like diabetes, many heart-related conditions are completely preventable by adopting a less sedentary lifestyle. With more investment going into ‘lifestyle’ devices and unregulated products that encourage patients to exercise and eat right, medical device manufacturers need to leverage their own expertise to add to the conversation.

3D printing

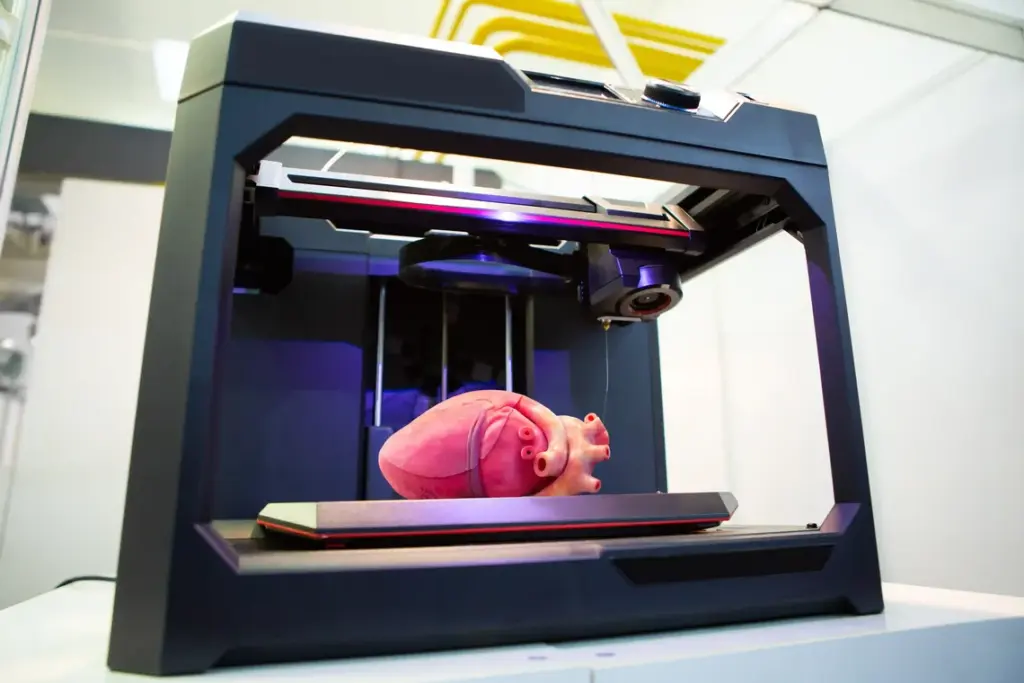

3D printing, or more specifically, additive manufacturing, is having a major impact on health ecosystems. Applications include printing tools and replacement parts for devices, on demand, in parts of the world where medical equipment servicing is difficult. 3D printing is also being used in orthopaedic and dental implants, providing custom prosthetics at the point of care.

One of the most interesting applications within healthcare is the viability of 3D-printed organs, using a combination of biological tissue from the patient and laboratory-grown stem cells. Although research is underway assessing the feasibility of 3D printed organs, a working, regulated solution, is many years away, all while the global transplant list continues growing.

In summary

Innovation is not the only factor impacting the global economics of healthcare. Societal factors, including an ageing, more sedentary population, will continue to increase the need for devices and therapeutics, and in a time of economic uncertainty, effective, affordable healthcare has never been in greater demand.