Tackling Scope 3 emissions is a game-changer for food and beverage manufacturers. Designing consumer-friendly, energy-efficient products can drive growth by reducing emissions and fostering guilt-free purchasing, leading to stronger brand connections and top-line success.

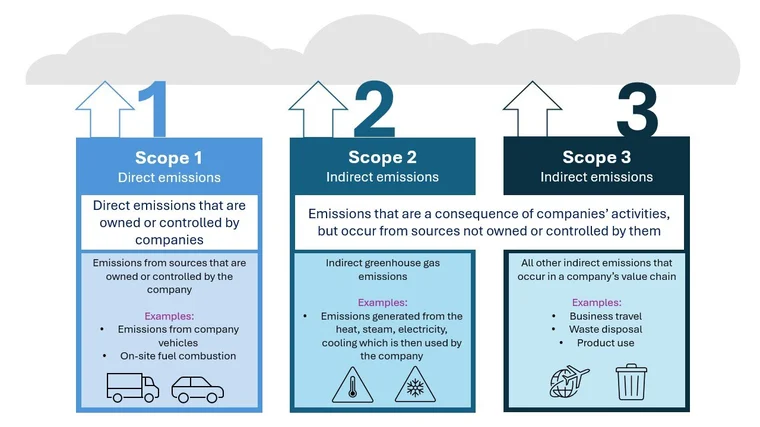

Scope 3 greenhouse gas emissions encompass all indirect emissions that occur throughout the value chain of a company, excluding direct emissions (Scope 1) and indirect emissions from purchased electricity (Scope 2).

For food and beverage manufacturers, Scope 3 emissions represent a significant portion of their carbon footprint, coming from a variety of sources, including agriculture, transportation and logistics, production of raw materials, packaging, and waste management.

Tackling these emissions can lead to plenty of benefits including bottom line growth. And we are not talking about trivial amounts here. According to a study published by the Food System Economics Commission, a shift towards a more sustainable global food system could create up to $10tn of benefits a year, improve human health and ease climate crisis.

Stuart Gilby, Head of Food & Beverage at 42T says, “It’s not just about ticking boxes – it’s about fundamentally transforming the industry’s footprint, reducing production costs simultaneously, and if done correctly, driving growth.

We have seen how changing to a growth mindset as a business driver for sustainability unlocks funding, focus and energy from R&D teams and can cause real impact for the environment as well as a change in what consumers can see and feel.

Our team of product consultants have faced many similar challenges in a variety of applications – they have some surprising technological ideas and expertise to offer which can give food and beverage (F&B) companies a distinct edge.”

Lightweight packaging

Global food and beverage manufacturers are increasingly focusing on packaging emissions related to transport and end-of-life use. These solutions can comprise simple lightweighting of current packaging, developing new delivery methods (reuse by customer or by return to base), through to using more sustainable materials, further decreasing the environmental impact.

Adopting lightweight packaging helps manufacturers reduce the volume of materials that need to be produced, processed, and transported, thereby cutting emissions at multiple stages of the product lifecycle. For instance, the reduction in material use directly lowers emissions from production processes and reduces fuel consumption during transportation due to lighter loads.

But lighter materials need to maintain product quality and not impact manufacturing speeds. Nestle, one of the biggest FMCG companies in the world, has been saving money with ever-thinner plastic bottles, cutting the content in its half-litres by more than 60% since 1990 – these changes save approximately 72 cents per pound of plastic resin.

Stuart says, “Concentrating products by removing water has been implemented in the home and personal care sector already, causing huge drops in Scope 3 emissions. F&B can learn from this industry and add a growth mindset by offering personalisation to products in this space. Consumers can adjust taste by adding water, making products playful, interactive and appear fresher which can drive purchase intent.”

Reduce and reuse

Alternatively, adding a reuse option can stop emissions due to transport costs to very low levels.

Companies such as Loop offer simple logistics to allow ‘return to manufacturer’ models with designers offering improved products for ease of use and cleaning, alongside new sanitisation equipment back with the manufacturers. Or better yet, is there scope where the consumer could use their own reusable packaging?

Sustainable materials

Whatever the packaging format, selecting more sustainable materials to increase recycling at end-of-life, or improve the circular economy, is a must. But many innovative sustainable materials will not drop into today’s manufacturing lines, leaving visions of large CAPEX purchases looming.

Stuart says, “CAPEX requirements are the graveyard of many innovations and sustainability is no different. However, many modern technologies can be retrofitted to legacy lines – something our engineers have done before to ensure projects can deliver maximum impact.

We have managed to modify production lines to ensure innovative sustainable materials can be used as a drop-in replacement by focusing on the key transformation steps required, such as folding and sealing. Only minimal changes are therefore needed in production lines, allowing a fast return on the investment without the need to finance large CAPEX purchases.”

By prioritizing this approach, UK companies can make significant progress in their sustainability goals, demonstrating leadership in the fight against climate change while also meeting increasing consumer demand for environmentally friendly products.

EXAMPLE: Coca-Cola European Partners (CCEP)

CCEP has taken significant strides in reducing the weight of its packaging. By switching to lighter bottles and cans, the company not only cuts down on the raw materials required but also reduces the overall carbon footprint associated with transportation. Less weight means more efficient logistics, translating to fewer emissions per unit transported.

Transport

While Scope 3 emissions can be the largest greenhouse gas (GHG) emissions for an organisation, they can be the hardest to target due to inability to directly impact the source.

From farm to factory to fork, the journey of food and beverages is fraught with carbon costs. Indeed, transportation costs typically account for 6% to 8% of revenues in the food and beverage industry.

Transport emissions explode in every part of the process: raw ingredients are shipped from farms, often across continents, to manufacturing plants. Once processed, products travel again to warehouses, retailers, and finally, to consumers. Each mile travelled adds to the carbon footprint, making logistics a key battlefield.

Which is why major brands are focusing on transport, either through lightweighting packaging or product, or moving transport to electric vehicles. For example, PepsiCo implemented data analytics to identify the most cost-effective routes and distribution centres. Reports indicate that companies employing such technologies have seen revenue and profit growth of approximately 10% compared to those not utilising these innovations.

What role do consumers play?

However, one area that is increasingly coming under focus is consumer emissions, such as cooking and freezing of food and beverage products.

But tackling these emissions requires changing consumer behaviours – something food and beverage companies are not always best suited to do. By taking lessons from other players in the consumer industry, F&B brands could help to drive growth as well as cutting Scope 3 emissions. As an example, innovation powerhouse Unilever launched Persil Wonder Wash, a detergent designed for short cycle cold washes, and it delivered top line growth with new sales.

Stuart says, “Scope 3 emissions by consumers themselves are coming under scrutiny. How much energy does it take to heat and cook a pizza? Or boil the water for a cup of coffee? These GHG emissions are also attributed to the brands producing the food and beverage that we all consume.”

Significantly, therein lies the opportunity for manufacturers – a few recent examples follow.

How manufacturers are tackling consumer Scope 3 emissions:

- Iceland has developed a range of products that can be cooked in the oven at the same temperature for similar time lengths, leading to an overall reduction in thermal energy – and hence GHG emissions. For the consumer, cooking dinner is now easier – as only one temperature is required

- Companies that offer ‘at home’ beverage machines are developing lower energy heating systems for the next generation of brewers, with a view to having no impact on consumer experience – apart from lower energy bills!

- Unilever has publicly shared information around making ice cream that can be kept at -12C rather than -18C. And while this is targeted at the freezers in our retailers – many other frozen food companies are working towards ‘warmer’ freezing of foods, while maintaining food safety standards.

How long will it be before we see food and beverage manufactures team up with white goods manufacturers to develop the next generation of freezers? Ones that are able to operate at both -12C and -18C temperatures, much like you can choose the temperature of your wash cycle when laundering.

By passing on some of these energy savings to consumers, or by making products easier to use, Scope 3 emissions will be reduced and will drive better customer engagement and loyalty amongst customer bases. New product lines can even drive growth if technologies are applied correctly.

Where to from here?

Stuart says, “By designing products with consumer usability at the heart and by also understanding the development of technology processes required, it is possible to move consumers to using less energy, emit fewer greenhouse gasses, and grow brands and products. By giving new offerings to consumers, it will allow guilt-free purchasing and improved customer interactions, which can lead to top-line growth.

Many of our clients who approach us with manufacturing issues end up having sustainability and emissions issues solved at the same time. For instance, we had a client with a heat-sealing issue on sustainable packaging who also achieved savings on energy costs when we solved the original problem for them. I can cite numerous examples of where this has occurred.”

What do manufacturers gain?

Food and beverage manufacturers who aggressively embrace the challenge of Scope 3 emissions stand to gain significantly. Firstly, there’s the promise of substantial cost savings.

Stuart says, “By optimizing supply chains, material usage and embracing more efficient transport options, companies can slash fuel costs and reduce waste. Streamlining operations not only cuts emissions but also trims fat from budgets, freeing up capital that can be reinvested into further innovation and growth.

Improved production efficiency is another massive win. Sustainable practices often go hand-in-hand with smarter, more agile operations. From leaner logistics to better resource management, manufacturers can enhance productivity while shrinking their carbon footprint. This results in a leaner, more resilient business model that is better equipped to handle market fluctuations and supply chain disruptions.

More importantly using sustainability as a medium for growth can lead to new categories, improved products, and better consumer engagement – all leading to better quality, improved customer loyalty and more sales. It has long been known that innovative business that changes with the market is more resilient when the economy struggles.

Stuart sums up, “Addressing Scope 3 emissions is a game-changer. It’s about cutting costs, boosting efficiency, and staying ahead of the curve in a rapidly evolving marketplace. Food and beverage manufacturers who rise to the challenge ultimately also set themselves up for long-term success and profitability.

Embracing sustainability now sets the stage for long-term success and profitability – those who focus on using growth as a driver to reduce emissions will secure their place in an increasingly eco-driven market.”